At the close of 2019, 2.82 million pets had health insurance, according to the North American Pet Health Insurance Association. Over the past five years, the industry has grown 22.1% annually on average. That outstanding growth rate is big news.

But pet insurance isn’t news to our readers. We’ve discussed the topic in depth twice over the past five years, in the September 2015 and March 2018 issues. And little has changed since those articles were published except for one thing: the increased number of companies offering wellness riders – optional insurance policy provisions that add benefits to or amend the terms of a basic policy.

“WELLNESS PLANS” ARE NOT HEALTH INSURANCE

Traditional pet health insurance plans help owners pay for the costs of diagnosis and treatment of unexpected and/or catastrophic injuries or illnesses; they don’t usually cover the cost of routine well-pet exams.

Historically, pet insurance companies have offered “wellness” or “preventive” coverage as an add-on to a traditional pet health insurance policy. These are often marketed as incentive programs that will motivate us to make annual or semi-annual well-pet visits. If you’ve paid for a well-pet visit already in the form of a wellness rider that will reimburse you for that visit, you are more likely to follow through and get your dog in to see the vet! The twist is: If you don’t go, you don’t get reimbursed!

We’re all for well-pet visits. Dogs who are seen by their veterinarians regularly are most likely to have any problems with their health detected in the earliest stages, when treatments are most effective. Any tool that encourages owners to schedule these visits can literally save dogs’ lives. There’s a big catch, though: Despite the fact that the insurance companies market wellness riders as a way that owners can reduce and plan for the cost of routine veterinary care, these plans won’t necessarily save you money. They can do so – but you have to be extremely organized and knowledgeable about what routine care your dog will benefit from in the year ahead in order to realize savings from their purchase.

HELPING KEEP YOUR DOG’S HEALTHCARE ON TRACK

To repeat: Classic wellness plans essentially act like a financial incentive program that encourages the pursuit of routine veterinary examinations by reimbursing the insured pet’s owner for a set of pre-selected benefits, such as a well-pet visit, a screening blood test, vaccinations, heartworm testing, etc.

For example, a wellness rider may cover the cost of an annual heartworm test and reduce the cost of monthly heartworm preventative medications. The routine administration of the preventative keeps your dog free of heartworms – and reduces the chance you will file a claim for a dog who needs treatment for heartworm disease.

As another example, some companies’ wellness plans reimburse owners for a significant part of the cost of an annual dental cleaning. In small dogs, many of whom suffer periodontal problems that result in tooth loss, annual cleanings can help a little dog avoid losing 20 teeth in a $3,000 surgery – a win for everyone involved.

WHAT’S THE CATCH?

Again, these wellness riders are offered as adjunct to, not replacements for, your dog’s health insurance, which is what does help cover the cost of unexpected trips to the vet for injury or illness. Think of wellness plans, instead, as a pro-rated trip or two to the vet, where the cost is spread across an entire year, which can help ensure it’s in your monthly budget.

As such, the potential reimbursements offered by the wellness plans are strictly limited in value. A plan that costs you $30 per month, for a total cost to you of $360 per year, might have an annual allowance of $400. Yes, the potential savings for that year is only $40 – and you will save that money only if you use every penny of the annual allowance by booking all of those wellness benefits. You could actually lose money on the plan if you fail to schedule and bring your dog in to your vet for the services you’ve paid for.

Honestly, it’s a bit like a casino: Unless you are a very savvy consumer, the odds favor the insurance company. It’s far more likely that the average dog owner will pay more for a wellness “plan” than they will receive as reimbursements for services their dogs enjoyed. You can get more value out of a wellness plan that you pay for in a monthly premium, but again, you have to be organized. You have to thoroughly research the plan ahead of time, making sure it will pay for (or significantly reduce the cost of) all the routine healthcare you plan to obtain for your dog – and then make sure you get that care. If you aren’t that disciplined, you may well lose money on these plans.

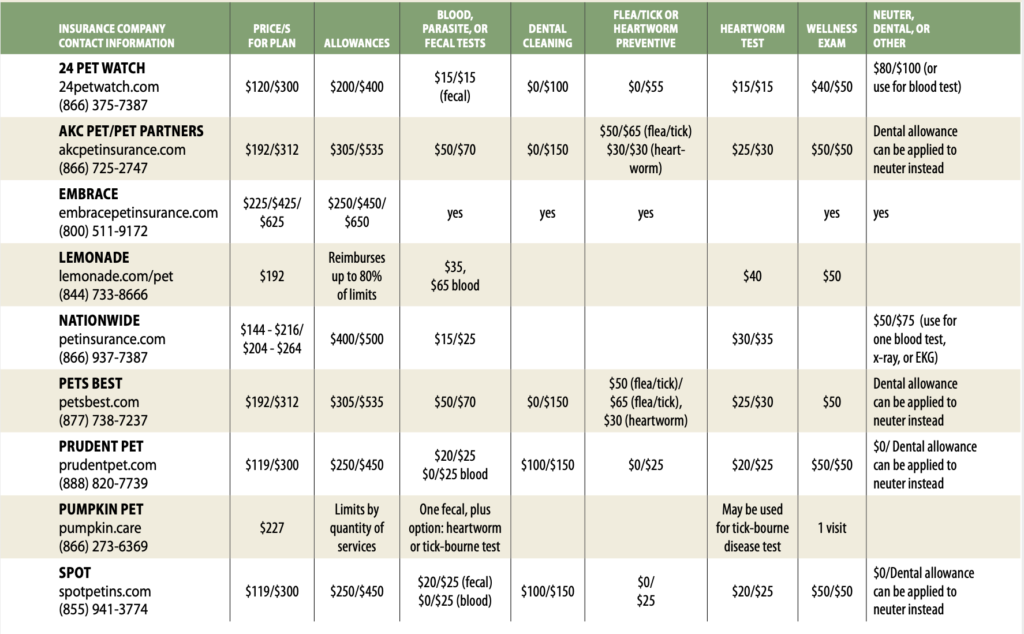

The table below lists only some of the many companies offering wellness riders to their health insurance plans and only some of the benefits the plans include. The health insurance companies don’t make it easy to compare their products with those of their competitors, but we’ve tried to simply illustrate how different the available plans are.

The prices listed here are the amounts we found for wellness plans for a 2-year-old, small, mixed breed dog. As we built this table, we noticed that prices and allowances change frequently; these are accurate as of 10/1/20.

Some companies offer more than one benefit level; we’ve used a slash symbol ( / ) to indicate the prices, allowances, and benefit levels of each tier of the plans offered.

The largest benefit offered by many companies in their wellness plans is a reimbursement that can be used either for a spay/neuter surgery, dental cleaning, or other major expense. Our guess is that this is done because a dog may need spay/neuter surgery as a younger dog or a dental as an older dog, but rarely both in the same year. We showed those major benefits in the last column.

COVERAGE WILL VARY

The wellness plans offered by pet health insurance companies vary widely. Some give you a ton of options; some lock you into a specific and limited set of veterinary services that qualify for reimbursement.

Some of the plans offer an extensive list of preventive options that you can use in their wellness plans. Embrace Pet Insurance, for example, includes Reiki, massage therapy, anal gland expressing, wearable pet activity monitors, acupuncture, and even medicated shampoos in the list of services that the plan will reimburse you for. Other plans, like Pumpkin Pet Insurance’s “Preventive Essentials Package,” focus on preventive basics with one well-pet veterinary visit, one fecal test, one test for a vector-borne illness test (such as Lyme disease), and two vaccinations.

The difference is reflected in the cost. A wellness rider from Embrace for a small 2-year-old dog would cost $35 a month (a total cost of $420 for the year) with a $450 allowance. It offers the widest range of coverage choices we found and doesn’t dictate how much you can spend on each item. You could choose to spend the entire $450 allowance on acupuncture therapy, if you wanted – and you could do it all the first month of coverage, if you wished, but you still would be required to pay the monthly premiums for both wellness and health insurance for the full year.

Most riders we examined used monetary limits for their wellness coverage by individual items. For example, AKC/Pet Partners will reimburse you for a maximum of $50 or $65 (depending upon the level you choose) for flea and tick prevention. The actual the cost of a year’s worth of spot-on flea treatment for a small dog is more than that – depending on the product used, it may cost as much as $120. In cases such as this, the plan simply helps defray the cost of caring for your dog; it won’t cover the entire cost.

Other plans cover a set quantity of specific services, such as the Pumpkin Pet package described above. The cost for this package for our hypothetical 2-year-old small dog would be $19 per month, for a total cost of $228.

That sounds great – mostly because, at many clinics, the cost of all that likely exceeds $228, so Pumpkin Pet’s reimbursement to you for all that should mean that you saved money. But you need to read the insurer’s customer agreement carefully to see if they have limits on how much they will reimburse you for that one veterinary wellness visit.

Many veterinarians and veterinary companies, like the 1,000-clinic Banfield Pet Hospital, have designed “wellness packages” for their clients. The benefit to you, as with any wellness coverage, is that it helps to defray the cost of the preventive measures your dog needs to be healthy. The benefit to them is that it pretty much binds you to their veterinary clinic for the year. These plans are prepaid preventive options that don’t require you to also purchase an accident/illness policy. They can be extremely helpful to those on a budget because, when working directly with your own clinic, you usually don’t have to pay the money up front and then be reimbursed. You just pay your monthly premium, and your dog gets the preventive care he needs. THE RIGHT RIDER Not all screening tests and preventive procedures are necessary. Ask your veterinarian for recommendations regarding preventive care and health screens, based on your dog’s age, activity, and predominant breed. Keep in mind that most of these riders are offered in combination with your accident/illness coverage. Because that part of your policy is your primary concern, the first thing you need to do is decide which insurer offers what you need for your dog. For more information about choosing a major medical policy, see “Rest Insured,” WDJ March 2018. To recap that article briefly: We advise that you choose an accident/illness policy without monetary or treatment policy limits and that you make sure that the actual fees on your veterinary invoice are used to determine reimbursement (as opposed to a “fee schedule”). Also important: Read the policy in full to ensure that any exclusions will not be a problem for you – and there are usually a lot of exclusions. For example, if you have a German Shepherd Dog, you’ll want to be sure hip dysplasia is covered. If you have a Papillon, look carefully at the dental coverage. Your veterinarian can offer an expert opinion to help you choose. After you’ve chosen your dog’s “health” insurance, read the wellness rider in full before you sign. Sometimes, the broad-strokes description of a wellness plan leaves owners with a more generous impression of what they will get for their money than what is described in fine detail in the customer agreement. And, finally, remember that you need to exhaust the available benefits of a wellness plan over the course of the policy year to make the policy worth having; the funds do not roll over from year to year. If you have a $450 allowance and you used only $300 of it, you will have lost $150 when the policy renews. Cynthia Foley is a freelance writer and dog agility competitor in Warners, New York.

Any body can recommend a good insurance for my dog..